do you pay taxes on a leased car in texas

Total sales tax paid in Texas 625 under current interpretation 2500. This means you only pay tax on the part of the car you lease not the entire value of the car.

What S The Car Sales Tax In Each State Find The Best Car Price

If you notice that scenario 2 and 4 are the same amounts I believe this to be the correct.

. No tax is due on the lease payments made by the lessee under a lease agreement. Car youre buying 50000 Car youre trading 30000 Trade Difference 20000 Taxes 2000006251250. This is different from most other states in which no such tax is charged to the lessor or the tax is administered in a different way.

The dealership is telling me that I will need to pay sales. In a couple of states such as Texas lessees must pay sales tax on the full value of the leased car versus just the tax on payments during the time of the lease. The lessor is responsible for the tax and it is paid when the vehicle is registered at the local county tax assessor-collectors office.

Nissan Juke 10 Dig-t 114 Visia 5dr. A motor vehicle purchased in Texas to be leased is subject to motor vehicle sales tax. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure.

In addition to taxes car purchases in Texas may be subject to other fees like registration title and plate fees. There are some available advantages to leasing a vehicle in a business name please consult your tax. Its sometimes called a bank fee lease inception fee or administrative charge.

Texas sales tax on car lease texas laws require that the lessor the lease company pay sales tax on the full value of any vehicle they buy from a dealer and lease back to a lessee you and me. Total sales tax paid in other states 625 if entire lease was paid eg. Any tax paid by the lessee when the motor vehicle was titled and registered in.

If you dont have a trade then youre simply paying taxes on selling price. A a tax is imposed on every retail sale of every motor vehicle sold in. Some dealerships may charge a documentary fee of 125 dollars.

A car lease acquisition cost is a fee charged by the lessor to set up the lease. Any rentals for less than thirty days are considered to be subject to a gross rental receipts tax at the rate of 10. In the state of Texas you pay 625 tax on Trade difference Example.

Does that mean you have to pay property tax on a leased vehicle. The most common method is to tax monthly lease payments at the local sales tax rate. EXCEPT in Arkansas Illinois Maryland Oklahoma Texas and Virginia where you pay sales tax on the.

In most states you only pay taxes on what your lease is worth. Acquisition Fee Bank Fee. Yes in Texas you must pay tax again when you buy your off-lease vehicle.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. Dear Driving for Dollars My lease is almost up and I would like to purchase the car. If the vehicle you are purchasing has Tax Credits from the manufacturer LM then your tax.

Lets say you leased a BMW 320i sales price is 33000 and your lease over 27 months totals 10000 Dollars then youd be responsible for sales tax of 625 on 10000 or 62500. In Texas all property is considered taxable unless it is exempt by state or federal law. The acquisition fee will range from a few hundred dollars to as much a 1000 for a higher-end luxury car.

Leased vehicles produce income for the leasing company and are in turn taxable to the leasing company. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. The lease contract is not subject to tax.

For vehicles that are being rented or leased see see taxation of leases and rentals. Dacia Sandero 10 TCe Bi-Fuel Essential 5dr. Total sales tax paid in other states 625 if entire lease was paid eg.

The monthly rental payments will include this additional cost which will be spread across your contract. Texas laws require that the lessor the lease company pay sales tax on the full value of any vehicle they buy from a dealer and lease back to a lessee you and me. VAT-registered companies can reclaim up to 100 of the tax on vehicle payments on a business lease and on any maintenance.

In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor vehicle sales and use tax. Technically there are two separate transactions and Texas taxes it that way. Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas.

Leased Vehicles for Personal Use. Residual is 0 1875. Total sales tax paid in Texas 625 if trade-in was considered 1875.

Technically BMWFS bought the car the first time and the tax was due from. All leased vehicles with a garaging address in Texas are subject to property taxes.

Car Accidents With Leased Cars Adam Kutner Attorneys

Car Leasing Costs Taxes And Fees U S News

What Is Residual Value When You Lease A Car Credit Karma

Will I Pay Sales Tax When Buying My Leased Car Fox Business

Why Tennesseans Should Consider Leasing Their Next Car Wreg Com

Sworn Statement Of Loss Vehicle How To Write A Statement Of Loss Or Damage To A Vehicle Templates Business Template Loss

Property Tax On A Leased Vehicle O Connor Property Tax Experts

Which U S States Charge Property Taxes For Cars Mansion Global

Move Your Leased Car Out Of State Blog D M Auto Leasing

Are Car Repairs Tax Deductible H R Block

10 Best Lease Deals Under 200 In May 2022 Kelley Blue Book

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

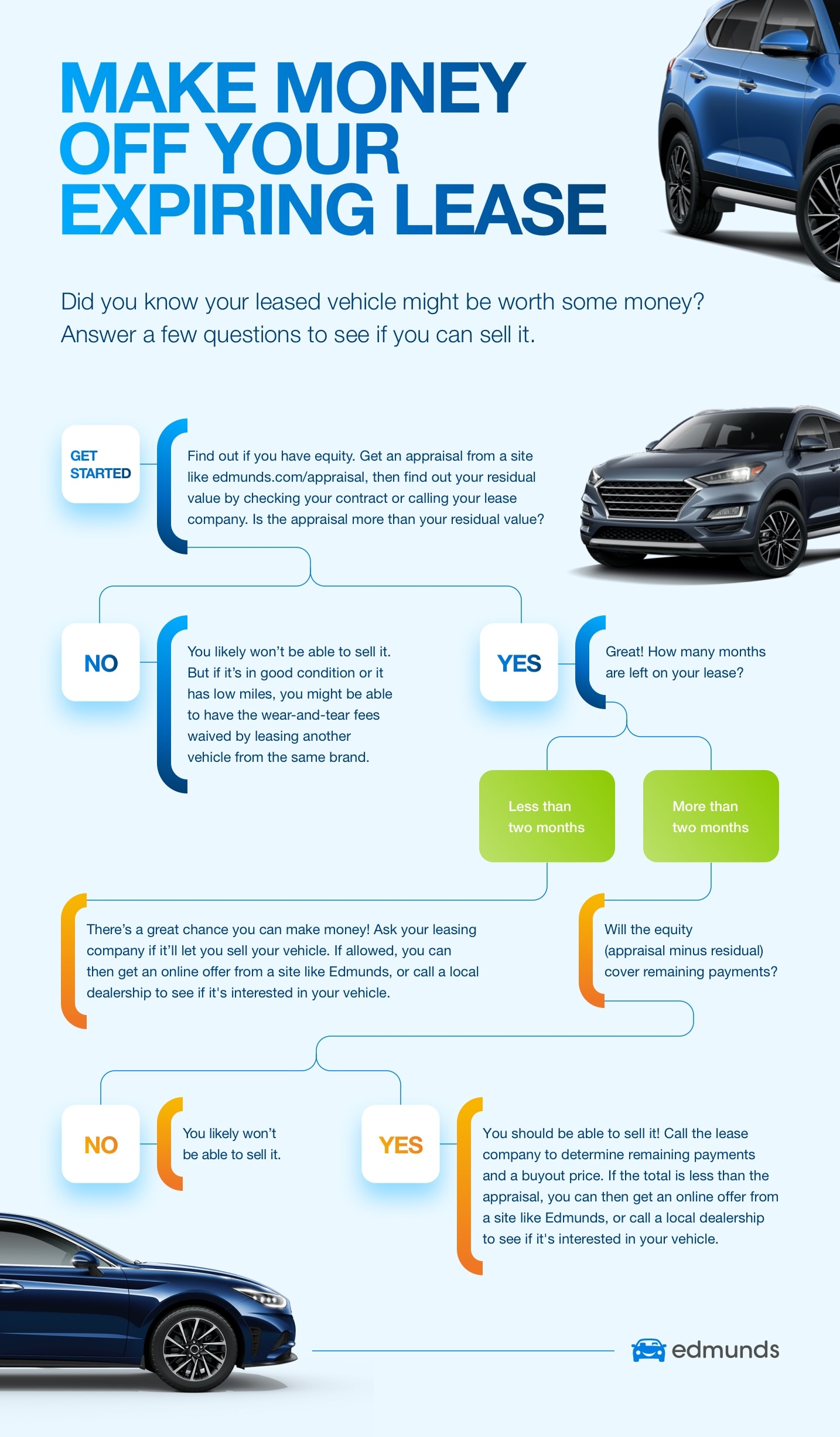

Consider Selling Your Car Before Your Lease Ends Edmunds

How To E File Form 2290 With Etax2290 Com Form Filing Trucks

Just Leased Lease Real Estate Search Property For Rent

Texas Car Sales Tax Everything You Need To Know

Buy Or Lease An In Depth Look At The Costs Of Buying And Leasing A Car Taxact Blog